How To Create A Pro Forma In four Steps

The balances are “adverse”, because I wanted to show you the way the cash could transfer (not the associated asset). For example, PPE elevated from to , however it implies that the company purchased PPE for and the Company’s cash decreased by that amount. Of course, it’s not necessarily reality (as there’s depreciation etc), but it’s the first step and the changes are made later. All plots have previously been revalued and as such the revaluation reserve surplus has a big steadiness that span all plots of land. the corporate has paid the revenue tax interest which is adjusted by way of provision for tax.

Company

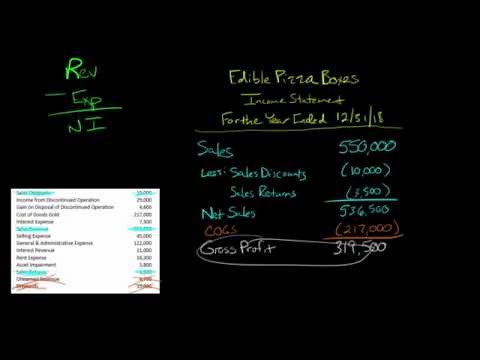

Pro forma profit before taxes is figured by subtracting the pro forma expenses from the professional forma gross revenue, or $315,000 from $550,000, for a pro forma revenue earlier than taxes of $235,000. Let’s assume that you count on gross sales to increase by 10 percent next yr.

A Pro Forma Statement Is An Important Tool For Planning Future Operations

It’s up to you—belief your expertise as a business proprietor. Set a production schedule that https://www.binance.com/ can allow you to attain your aim, and map it out over the time period you’re covering.

Pro Forma Total Expenses

Kindly tell us about the right therapy of write offs in money circulate assertion. So in each of the above instances the write offs are actually resulting in a money influx, However, logically write offs should have no impression on cash in developing the pro forma income statement, we follow four important steps: flow statement or both lead to money outflow not inflow. Just when I thought i had forgotten how to prepare cash circulate assertion, voila your page bounced me back. Thanks a lot for the properly detailed and explanatory write up…Thumbs up.

The U.S. Customs and Border Protection, for instance, makes use of pro forma invoices to assess responsibility and study goods, but the importer on document is required to post a bond and produce a business invoice within one hundred twenty days from the date of entry. If the required industrial bill is required for statistical purposes, the importer has to provide the business bill inside 50 days from the date Customs releases the products to the importer.

As the document does not constitute precise sales, so no entry is made on the difficulty of the proforma invoice within the books of the vendor for accounts receivable and the receipt of the buyer for accounts payable. In addition to cap price, there are other baseline formulation and metrics you need to familiarize yourself with and put into follow whereas analyzing investments. Cash move, cash-on-money return, and IRR are a couple of other gadgets you should perceive in the actual property investing world.

- A pro forma revenue statement is normally a monetary statement that makes use of the pro forma calculation method, often designed to draw potential buyers’ focus to specific figures when a company points an earnings announcement.

- The function of pro forma financial statements is to facilitate comparisons of historic information and projections of future efficiency.

- Pro forma changes to accounting principles and accounting estimates reformat the statements of the brand new entity and the acquired enterprise to adapt with those of the predecessor.

- A simplified and fewer formal statement may only show money in and money out along with the beginning and ending cash for each interval.

- Essentially, pro forma statements current expected corporate results to outsiders and are sometimes used in investment proposals.

- Companies can also design pro forma statements to evaluate the potential earnings worth of a proposed business change, similar to an acquisition or a merger.

What is the difference between proforma and projected?

The traditional form is “pro forma” (two words).

How many occasions did you sit with the head in your palms worrying in regards to the assertion of money flows? Investing actions embrace buying and promoting belongings like property and tools, lending cash to others and amassing the principal, and shopping for/selling funding securities. This part of the assertion is associated with the Long-Term Assets part of the steadiness sheet. Prior to completing a professional forma analysis, an analyst will compile an intensive monetary evaluate to make sure correct and up-to-date data. This monetary evaluate will provide the information needed for the analyst to compile a pro forma evaluation.

Your costs shall be your lease, worker pay, insurance, licenses, permits, materials, and so forth. To create the primary part of your pro forma you’ll use the income projections from Step 1 and the entire liabilities and prices found here. gross sales had been %keywords% from beginning inventory till it was depleted, after which would use sales from current production. sales were from current production till present manufacturing was depleted, and then would use sales from beginning stock.

What are the basic benefits and purposes of developing pro forma statements?

The presumptions about hypothetical conditions that occurred in the past and / or may occur in the future are used to project the most likely outcome for corporate results in reports known as pro forma financial statements.

Since none of us has a crystal ball, forecasting years upfront is tough to do and never always entirely dependable. The inside rate of return, or IRR, measures the rate of return earned on an funding during a specific in developing the pro forma income statement, we follow four important steps: time frame. It contains cash circulate and any income from a property’s sale. Simply put, IRR represents a property’s web cash circulate and expected appreciation divided by the target hold time.

In the Federal government of the United States, either house of the Congress (the House of Representatives or the Senate) can maintain a professional forma session at which no formal business %keywords% is expected to be conducted. They have also been used to stop presidents from making recess appointments.

What is a proforma statement?

In my opinion the key difference between the two is as follows: Financial projections are built on a set of assumptions, and can be built from scratch for a startup company. Pro Forma financial statements on the other hand are based on your current financial statements, and then are changed based on one event.

provide practically the liquidity of cash however earn a modest return, they tend to have maturities of lower than one yr. Furthermore, the rate at which these securities could be purchased or sold has little effect on their costs. Highly liquid quick-term debt investments held by firms as a substitute of money. The collections and purchase schedules measure the pace at which receivables are collected and purchases are paid. To the extent collections do not cover buying prices and other monetary necessities, the firm must look to borrowing to cowl the deficit.

since it’s a non money objects it is added again to profit what will be the next effect of that. it’s a tremendous https://cex.io/ technique to organize cash move statement.

It takes into consideration an injection of money from an outside supply—plus any interest payments you may need to make—and exhibits how it will affect your small business. This sort of pro forma projection takes into account https://cryptolisting.org/blog/what-is-a-pro-forma-operating-budget all your financials for the yr up until the present time, then adds projected outcomes for the remainder of the yr. That might help you present investors or companions what business finances could look like by the end of the year.